Excitement About What Is Trade Credit Insurance

Wiki Article

The Ultimate Guide To What Is Trade Credit Insurance

Table of ContentsSome Known Factual Statements About What Is Trade Credit Insurance See This Report on What Is Trade Credit InsuranceThe 7-Minute Rule for What Is Trade Credit Insurance

After that, during the year, if any of those customers go breast or don't pay, after that we will certainly make the repayment. We look at the entire turn over of a business and we finance the whole. "What we're translucenting electronic platforms is that people can go online and also can offer a single billing.

What the consumer can then do is take the selection to insure that solitary invoice. "At Euler Hermes, we think there's going to be a shift in the method profession credit report insurance is distributed.

The Ultimate Guide To What Is Trade Credit Insurance

Need a broker? See our guide to finding the ideal broker.

For instance, a producer with a margin of 4% that experiences a non-payment of 50,000 would certainly need 25 comparable sales to make up for a solitary circumstances of non-payment. Credit insurance reduces versus this loss. You can cut costs on credit information as that's covered, and also you won't require to throw away resources on going after collections.

You may have the ability to work out good terms with your suppliers as a credit score insurance coverage policy reduces the influence of an uncollectable loan on them and also potentially the entire supply chain. Debt insurance useful reference policy exists to aid you stop as well as reduce your trading threats, so you can develop your service with the expertise that your accounts are secured.

A company desired to broaden sales with its present customers but was not completely comfy providing them higher credit report limits. They spoke to Coface credit history insurance policy to cover the greater debt limitations resource so try these out they can raise the amount of credit history offered to clients without risk - What is trade credit insurance. This let them grow incomes as well as deliver more revenues.

Things about What Is Trade Credit Insurance

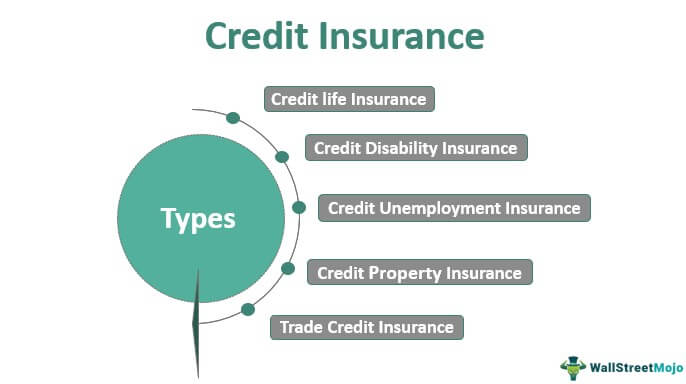

"From the first objective of offering convenience to our financial institutions, the service included depth to our company choices." The communication permitted the company to examine its clients' problem a lot more properly and has actually been an important device in service growth.Taking out trade credit rating insurance coverage is one means you can do this. Profession credit insurance policy supplies cover when a consumer either becomes financially troubled or does not pay its financial obligations after a particular period (which is set out in the insurance plan).

"In the event a financial debt is unsettled, the plan owner might be able to claim as much as 90 per cent of the quantity of that financial debt, taking right into account any type of excesses that might be appropriate," he includes. When it involves collecting the financial obligation, usually the insurer will have its very own debt collection company as well as will pursue the debt in behalf of the service.

Report this wiki page